Form 627 is an application to renounce Israeli residency status within the Bituaḥ Leumi (National Insurance) system. This process is crucial for individuals relocating abroad for an extended period and who do not plan to use Israel’s social insurance services or make contributions. Submitting this form can help avoid unexpected debts of tens of thousands of shekels and complications with official authorities. If you are leaving Israel for more than just a vacation, make sure to fill out and submit Form 627!

In this article, we will provide detailed instructions on how to complete this form and where to send it (free and without SMS!).

What is residency status in Bituaḥ Leumi, and why renounce it?

Bituaḥ Leumi manages social payments and benefits such as unemployment, maternity, disability, and pensions. Your residency status with Bituaḥ Leumi determines eligibility for these benefits and the obligation to pay insurance contributions. Even if you are abroad, you will still be required to pay these contributions unless you officially cancel your residency status by submitting Form 627. In principle, Bituaḥ Leumi may revoke your residency status automatically after about five years. However, if you prefer not to pay these contributions, it is better to withdraw from the system yourself.

💡 Note that residency status in Bituaḥ Leumi and tax residency are separate matters. This article covers only residency for Bituaḥ Leumi.

Why renounce residency in Bituaḥ Leumi?

To avoid accumulating debts. While you are considered a resident of Israel, Bituaḥ Leumi expects regular payments. If you do not inform the service about your long-term relocation and fail to submit Form 627, debts can accrue, potentially leading to blocked bank accounts or legal enforcement actions.

Renouncing residency with Bituaḥ Leumi is not permanent. You have the right to re-establish residency upon return. When you return to Israel, you can restore your status and regain access to social benefits by completing a registration process.

Do homemakers need to submit Form 627?

In Israel, a married homemaker is exempt from paying insurance contributions, with her spouse covering payments for both. However, if both spouses are leaving Israel, Form 627 must be submitted for each individual. Even if the homemaker has never made contributions, her status depends on her spouse’s residency status. If her spouse loses residency, she will no longer hold the “homemaker” status either. Therefore, both need to submit the form to become non-residents in Bituaḥ Leumi.

Where to find Form 627?

The form is available on the official Bituaḥ Leumi website. You can download Form 627 via this link.

Once completed, you can submit the form at your local Bituaḥ Leumi office or upload it online through your personal account on their website.

Step-by-Step Guide to Completing Form 627

The form must be printed and filled out by hand in Hebrew—it consists of 3 pages and 10 sections.

To make it easier to translate the sections and understand what to write, use Google Translate’s image translation feature. Download the form to your computer or phone, upload it as an image, and translate it into any language.

Page 1

The top part of the first page should not be filled out:

Section 1: Personal Details (פרטים אישיים)

Fill in your last name, first name, Teudat Zehut number, date of birth, Aliyah date, and marital status. If married, provide your spouse’s details: name, Teudat Zehut, address, email, and phone number.

The following section should remain empty unless the contact details provided do not belong to you:

אם הטלפון הנייד או הדואר האלקטרוני אינם שלך – נא השלם את הפרטים הבאים:

Do not fill this section if the phone number and email belong to you.

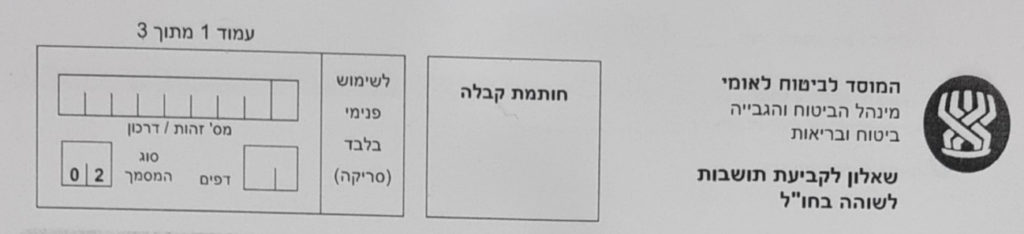

Section 2: Details of Stay Abroad (פרטים על השהות בחו”ל)

1 – From what date are you a non-resident (departure date from Israel)?

2 – Which country did you move to?

3 – What is the purpose of your stay (e.g., studies, work, immigration)?

If you are not employed by an Israeli company or government, leave the bottom section empty. Otherwise, provide relevant work details.

Page 2

At the top of the second page, write your Teudat Zehut number again (נא למלא מס’ תעודת זהות).

Section 3: Estimated Return Date (תאריך חזרה משוער)

If you do not know your return date, select the second option (תאריך החזרה אינו ידוע). If you do know it, select the first option (אני מתכוון לחזור לישראל בתאריך).

Section 4: Acquisition of Foreign Citizenship or Status (רכישת אזרחות ומעמד בחו”ל)

If you hold additional citizenship from birth, select “Yes” and provide the country and your date of birth. If you have not acquired any additional citizenship, select “No.”

Answer the following questions:

- Are you in the process of acquiring foreign citizenship?

- Do you have a work visa abroad?

- What is your legal status during your stay abroad?

Section 5: Family Members During the Stay Abroad (פרטים על בני המשפחה בזמן השהות בחו”ל)

Is your spouse staying with you abroad?

Do you have children under 18?

Does your spouse hold foreign citizenship? (If yes, specify the country.)

Is your spouse in the process of acquiring foreign citizenship?

Section 6: Information on Assets, Income, and Employment (פרטים על נכסים, הכנסות ועיסוקים)

Do you own property in Israel?

Is the property rented out during your stay abroad?

Do you have any sources of income?

Please specify the sources of your income.

Section 7: Bank Account Details in Israel (פרטי חשבון הבנק בישראל)

If you have an active bank account in Israel, provide the account holder’s name, bank name, branch (Snif), and account number.

Page 3

At the top of the third page, write your Teudat Zehut number again (נא למלא מס’ תעודת זהות).

Section 8: Tax Payments (תשלומי מיסים)

Do you pay income tax in Israel as a resident?

Section 9: Declaration of Intent (Mandatory) (הצהרת כוונות – חובה למלא)

Use this section to provide additional information that could help determine your residency status. This section is relevant if you want to retain residency despite living abroad.

Section 10: Declaration (הצהרה)

Indicate whether you wish to retain your residency status (first option) or cancel it (second option). If canceling, specify the effective date (e.g., the date of your departure from Israel).

Double-check all the information, sign, and date the form.

Leave the bottom section blank; it will be completed by Bituaḥ Leumi staff.

How to Submit Form 627 Online?

Scan or photograph the completed form. You need to combine the three pages into a single file, as the website allows only one document upload, with a size limit of 10 MB.

To combine the images, name them 1.jpeg, 2.jpeg, and 3.jpeg, and place them in an empty folder. Select all images, right-click, and choose “Print.” In the printer settings, set the pages to portrait orientation and print them as a PDF using the “Print to PDF” option.

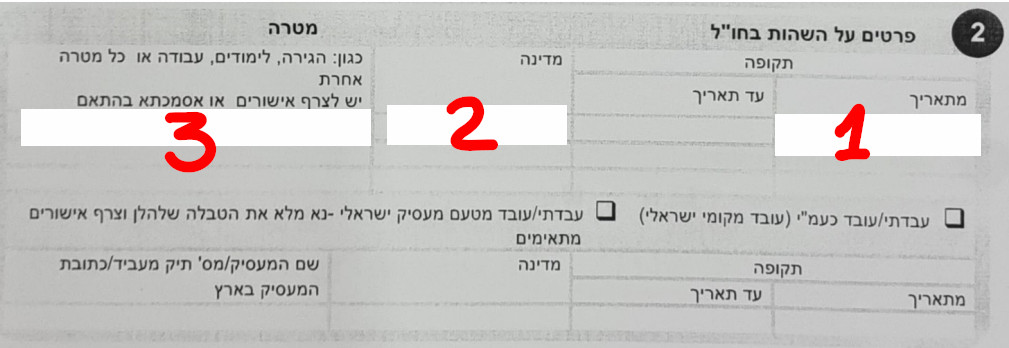

Now, upload the form to the Bituaḥ Leumi website:

Select “Upload Documents” (1 – העלאת מסמכים) to open the document upload page.

In fields 2, 3, and 4, select the following options:

2 – ביטוח וגבייה (Insurance and Collection)

3 – תושבות/שהות בחו”ל (Residency/Stay Abroad)

4 – שאלון לקביעת תושבות (Residency Questionnaire)

The default city listed in field 5 will correspond to your registration in Bituaḥ Leumi.

Click on (6) to attach your PDF file. Wait for the upload to complete, then click “Submit Document” (7 – שלח מסמך) to send your request.

After submission, you will see the following message on the website:

הנתונים נשמרו בהצלחה וממתינים לקליטה. The data has been saved successfully and is pending processing. After processing, the documents will appear on the Received Documents page.

The quest is complete! Once your request is reviewed, you will be notified of the change in your residency status. You can check your status in your Bituaḥ Leumi personal account.